© Tillypad, 2008-2015

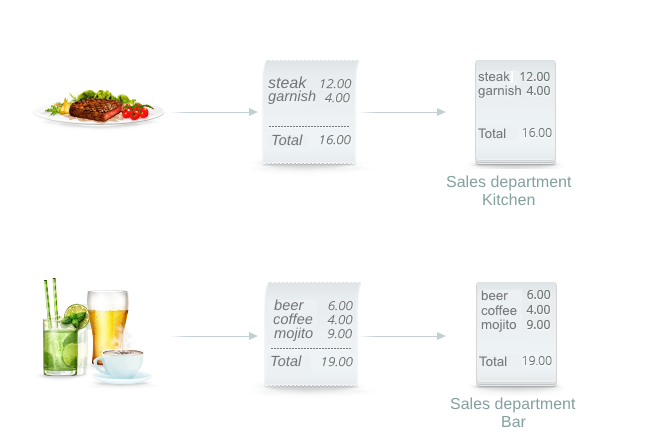

In this example, the restaurant's POS terminal offers customers dishes prepared in the kitchen and drinks made at the bar.

Each menu item is connected to one of two concurrences (Bar or Kitchen).

Three stores have been created for the restaurant (Bar, Kitchen, and Main store). Purchased stock items are entered into Main store records, after which they are moved to the Bar and Kitchen stores.

Drink sales are accounted for in one sales department (Bar). Sale of dishes prepared in the kitchen are accounted for in a different sales department (Kitchen).

One fiscal register(Bar FR) is used for fiscal registration of payments for dishes and drinks. Payments on the bar POS terminal can be made in cash, using a bank card (Visa) or with a regular customer card (Guest card). Payment via regular customer cards is carried out without fiscal registration.

Bank card authorisation is run on an authorisation device (Bank card authorisation) with a PIN pad (PIN pad), and regular customer authorisation takes place on the Tillypad system authorisation device (Tillypad client authorisation).