- Licensing system

- Cumulative payment

- VAT in the sales system

- Discounts and rounding modes

- Comments in the guest tab

- Changes in the menu

- Inheriting security level

- Reports and printing

- Update packages and Import

- System settings

- Changes in the Tillypad XL Manager directories

- Changes in the Tillypad XL Manager interface

- New interface of Tillypad XL POS

- POS screen buttons, button function settings

- Printing on the POS terminal

- Parameters of POS modes

- Restricted operations on POS terminal

- Miscellaneous changes for POS

- System installation

- Changes made to mobile device operation

© Tillypad 2008-2014

No. 45531

In the section all prices and cost prices are calculated with VAT.

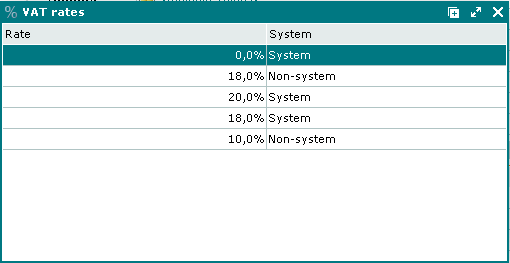

The new directory, VAT rates

No. 44960

The directory was added to the section.

All tax rates applicable to prices of stock items and menu items can be found in this directory.

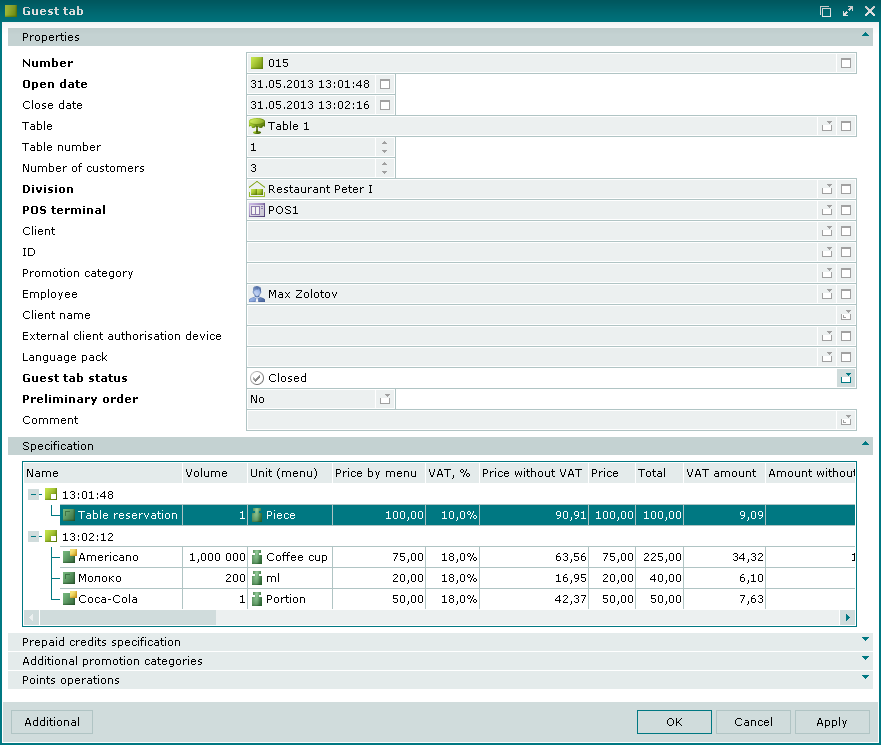

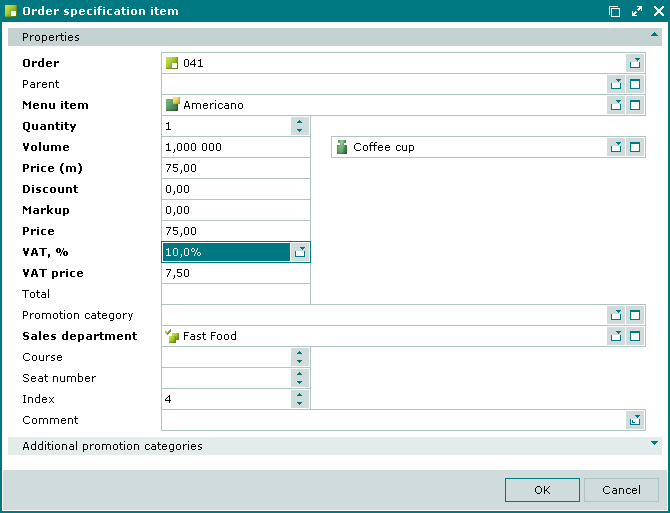

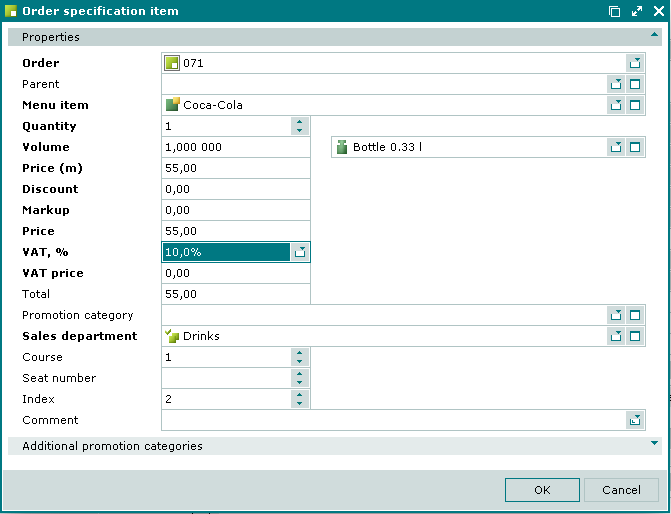

VAT in the order specification

No. 46490

The following fields were added to the order specification: VAT,%, VAT price, VAT free price, as well as VAT amount, Amount without VAT.

Order specification items are grouped according to their VAT rates.

The VAT,% and VAT price fields are displayed in the item specification panel. Tax rates are selected from the directory.

VAT,% is the value added tax rate (VAT) in percentage. This is a required field.

VAT price is the amount of VAT in the price expressed in monetary units. This is a required field.

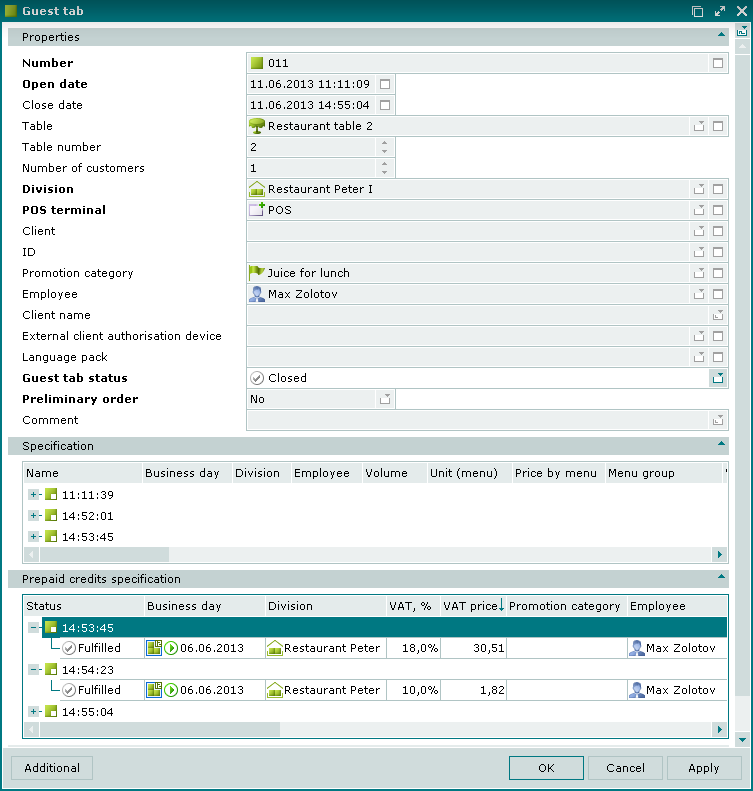

No. 49277

The following fields were added to the prepaid credits specification in the guest tab: VAT,%, VAT price.

The prepaid credits are grouped by VAT rates according to the VAT rates of the ordered dishes. Total prepaid credits must equal the total cost of dishes with the same VAT rates. If these amounts do not match, the extra or the missing payment items will be balanced out by the cumulative payment item of this division in the final settlement of account.

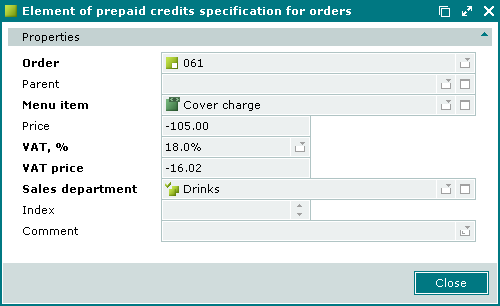

The VAT,% and VAT price fields are displayed in the prepaid credits specification item window.

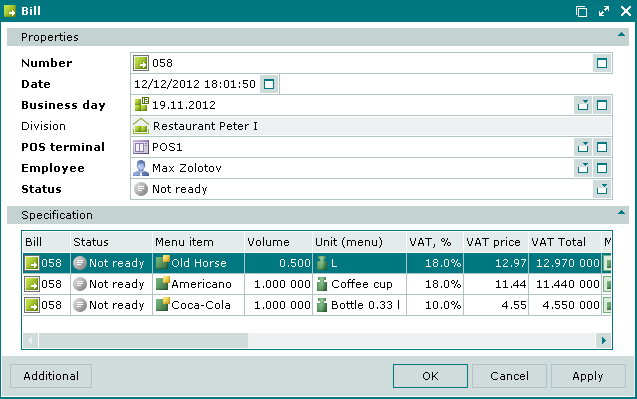

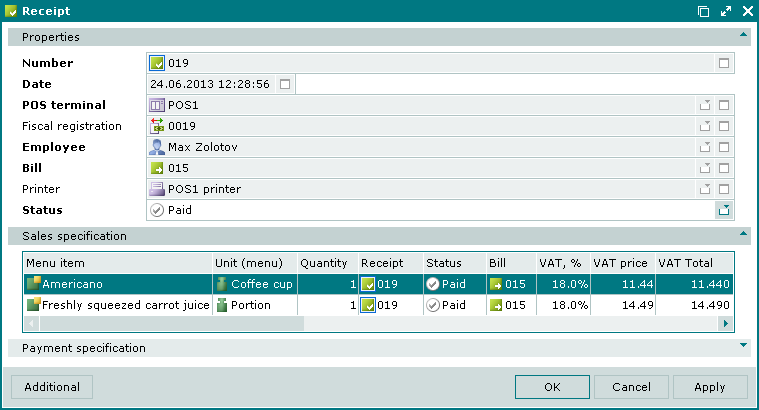

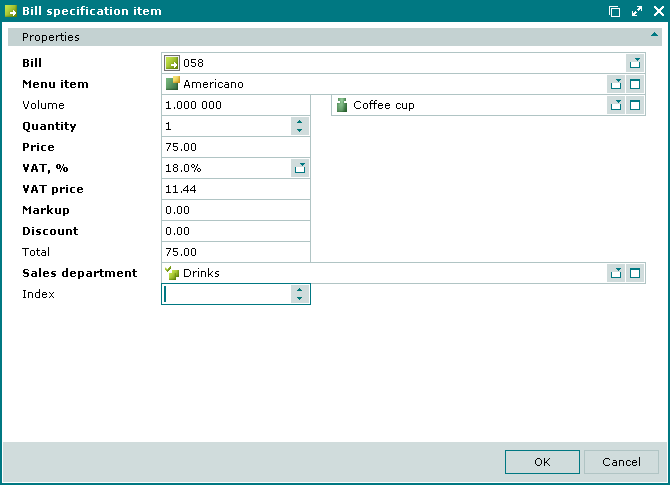

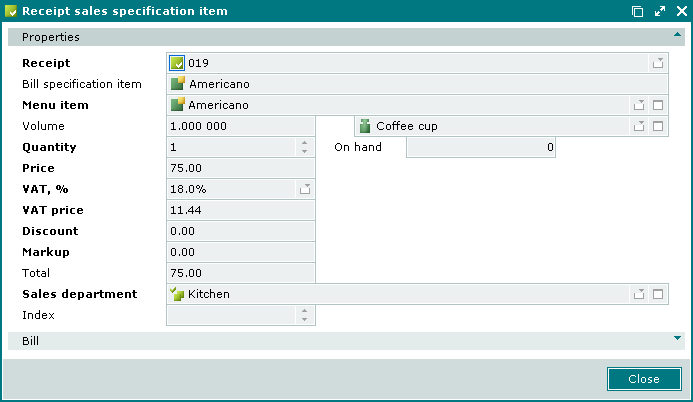

VAT in bills and receipts

No. 45549, 47239, 49291

The VAT,%, VAT price, and VAT amount fields were added to the bill and receipt sales specifications.

The VAT, % and VAT price fields are displayed in the bill specification item and receipt sales specification item windows.

VAT,% is the value added tax rate (VAT) in percentage. This is a required field.

VAT price is the amount of VAT in the price expressed in monetary units. This is a required field.

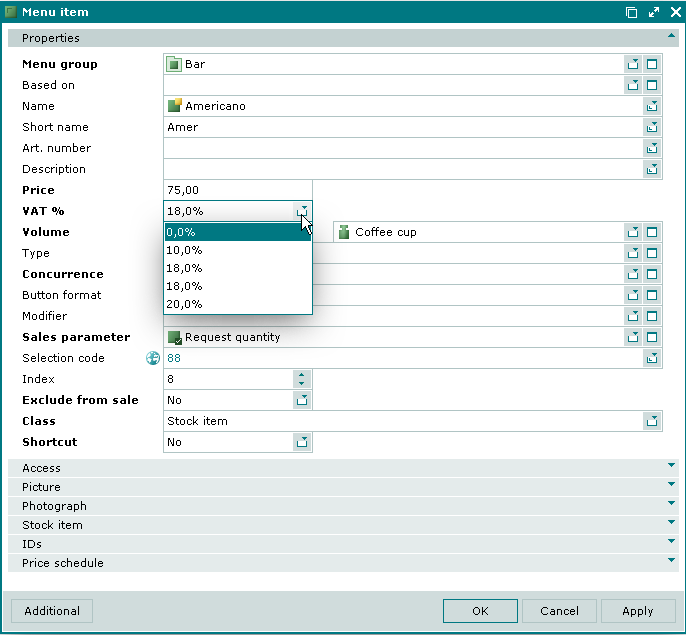

VAT in the menu

No. 44724, 44959

The VAT, % field is added for menu items and draft menu items. Values are selected in the directory.

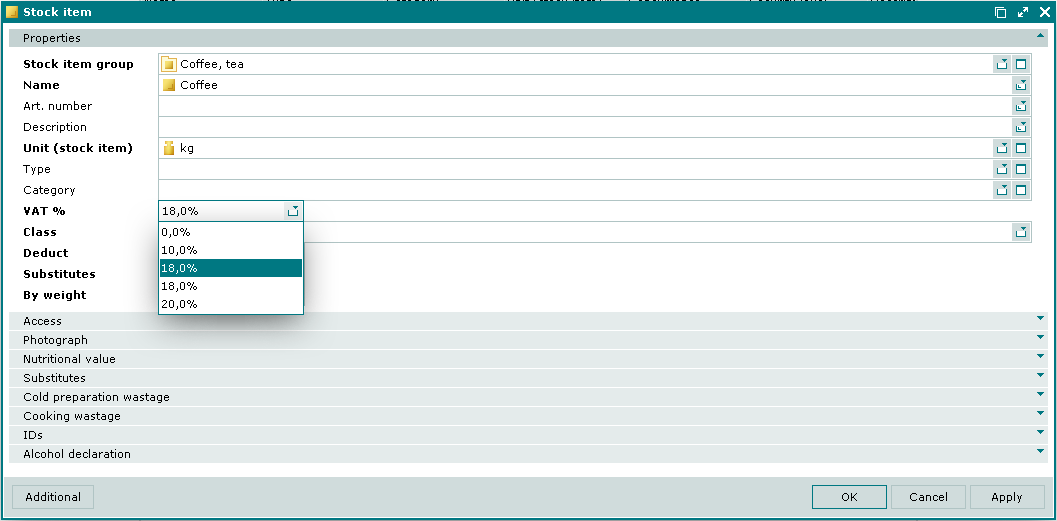

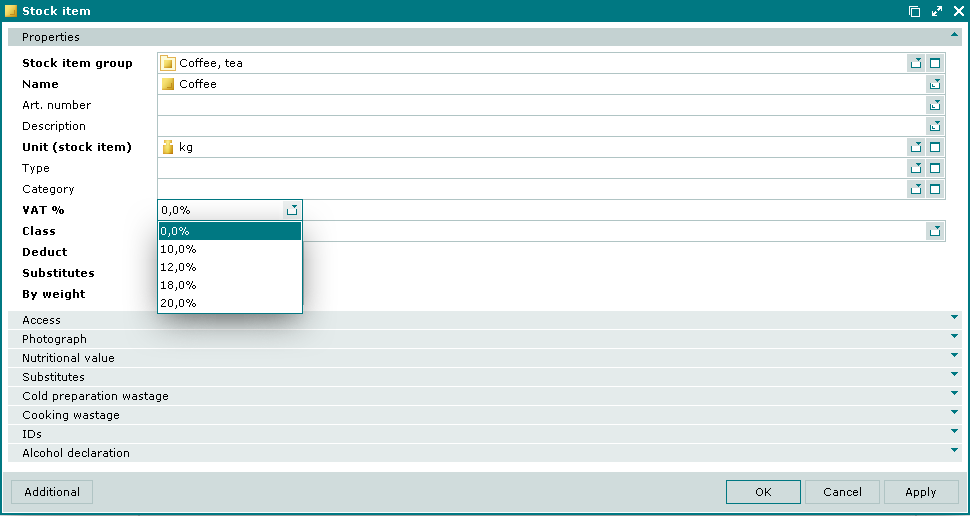

VAT in stock items

No. 44961

Values in the VAT, % field of the stock item window are taken from the directories.

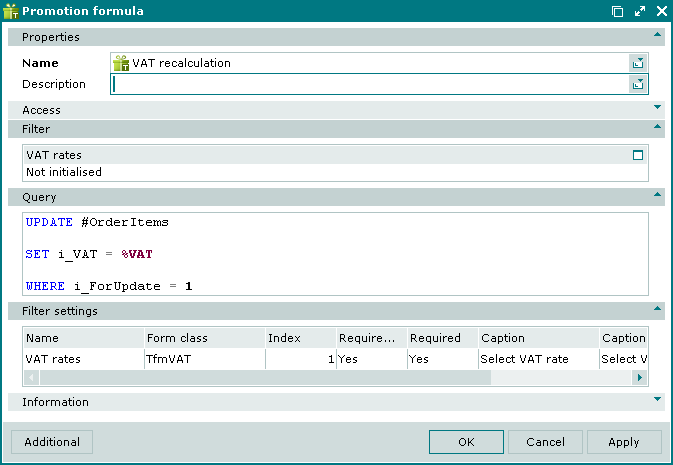

VAT in Promotion formulas

No. 45547

Now VAT rates can be changed in the promotion formula using a SQL query.

After a promotion category was assigned and amounts were recalculated according to the promotion type for the order item, the value in the VAT price field will be adjusted to the price and the new VAT rate.

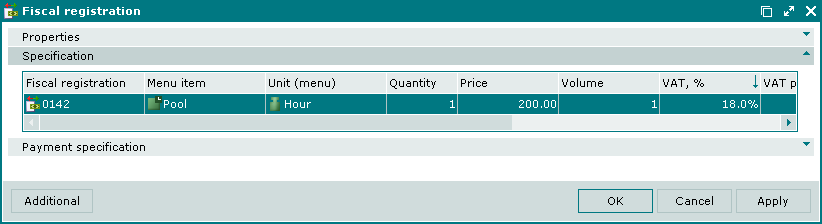

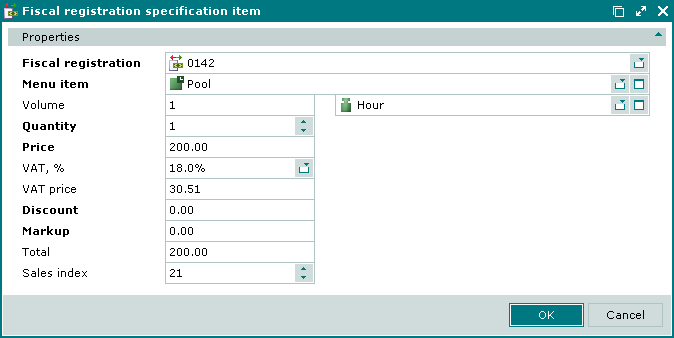

VAT and fiscal registrations

No. 46781, 46366

The VAT,% and VAT price fields were added to the fiscal registration specification.

The optional VAT, % and VAT price fields are displayed in the fiscal registration specification item window.

When payments are made, these fields are populated automatically.